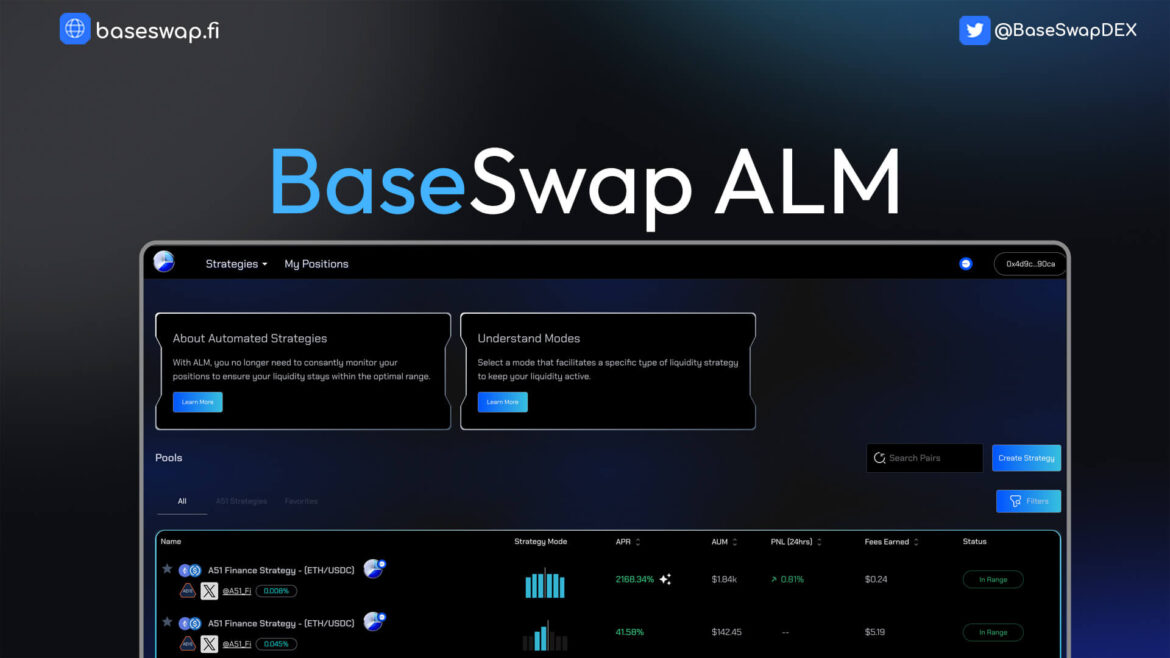

Exciting news for DeFi enthusiasts! BaseSwap has rolled out a major new feature—Automated Liquidity Management (ALM)—powered by A51 Finance. This innovative tool promises to simplify the often-complex process of managing liquidity, offering users a more efficient and rewarding experience.

Why Automated Liquidity Management is a Game-Changer

For those familiar with liquidity provision, the manual management of liquidity pools can be both time-consuming and tricky. BaseSwap’s new ALM system is designed to eliminate these hassles by automating the entire process. This allows liquidity providers to focus on maximizing earnings without constantly monitoring their positions.

The partnership with A51 Finance brings a fully automated liquidity solution to BaseSwap, integrating liquidity management into a seamless, user-friendly experience.

Over 20 Professional Strategies or Customize Your Own

One of the standout features of the new ALM system is its flexibility. Users can choose from over 20 professionally designed strategies tailored to different risk profiles and market conditions. These strategies aim to provide liquidity providers with optimal rewards, without requiring hands-on management.

For those who prefer a more personalized approach, the ALM system also allows users to create their own custom strategies, offering full control over how liquidity is managed.

Simplified Earnings with One-Click ALM Vaults

BaseSwap’s ALM system introduces one-click access to liquidity vaults. This means users can easily “zap” into vaults without having to manually adjust ranges or swap assets. The system handles everything in the background, from optimizing assets to automatically adjusting ranges in real-time. This hands-free solution makes earning rewards easier than ever.

High APRs and Exclusive Rewards for ALM Users

To sweeten the deal, BaseSwap is offering exclusive rewards for users who participate in ALM vaults. With some of the highest APRs in the market right now, liquidity providers can take advantage of the automated system to maximize returns with minimal effort.

A Step Forward in BaseSwap’s Innovation Journey

This ALM launch is part of BaseSwap’s ongoing commitment to innovation. Recent updates, such as the migration to V3 pools, a revamped dashboard, and a streamlined user interface, show the platform’s dedication to improving the DeFi experience. Additionally, the introduction of the EURC stablecoin and exclusive ALM vaults reflect BaseSwap’s focus on expanding its offerings for users.

How to Get Started

BaseSwap’s Automated Liquidity Management system is now live! Users interested in automating their liquidity strategies and earning enhanced rewards can explore the available strategies and vaults directly on the platform.

For more information and to begin using ALM, visit BaseSwap.

This is a significant leap forward for liquidity management in the DeFi space, and with automated solutions like this, BaseSwap is setting a new standard for user-friendly and efficient liquidity provisioning.