Merkel by Angle Protocol is emerging as a powerful tool for optimizing liquidity rewards in the DeFi space. Designed to make liquidity provisioning more efficient, Merkl allows projects to distribute incentives dynamically and transparently. Here’s how it works, why it’s gaining traction, and how it’s transforming DeFi liquidity rewards.

What is Merkl?

Merkl is a rewards distribution platform that is deeply integrated with the Angle V3 protocol. It’s designed to optimize and streamline the way liquidity providers (LPs) receive rewards, ensuring seamless and real-time distribution without the need for frequent manual interaction. By doing so, it simplifies the reward claiming process and provides more efficient reward allocation for both LPs and DeFi protocols.

Why Liquidity Rewards Matter in DeFi

Liquidity is the lifeblood of decentralized finance, providing the necessary pool of assets for decentralized exchanges (DEXs) and lending protocols to operate smoothly. To incentivize users to provide liquidity, DeFi projects often offer rewards in the form of native tokens or other incentives. However, manual distribution of these rewards can be slow, complex, and prone to inefficiencies.

Merkl addresses these issues by automating the rewards process through smart contract technology, ensuring that LPs are compensated accurately and in real-time.

Key Features of Merkl

- Real-Time Reward Streaming

- Liquidity providers using Merkl can earn rewards in real-time, rather than having to wait for manual distributions or periodic updates. This makes it easier for LPs to monitor and optimize their earnings.

- Customizable Incentives

- Merkl allows DeFi protocols to customize their incentive structures, meaning projects can tailor reward systems based on specific needs, market conditions, or liquidity goals. Whether it’s rewarding high-stake LPs more or targeting certain liquidity pools, Merkl offers the flexibility to do so efficiently.

- Transparency and Security

- Built on the Ethereum and Base ecosystems, Merkl leverages the security of these platforms to provide a trustless, transparent reward system. Users can track their rewards on-chain, ensuring complete transparency in the distribution process.

- Gas-Efficient Rewards

- One of the standout features of Merkl is its gas efficiency. By batching transactions and distributing rewards smartly, Merkl reduces the cost associated with gas fees, making it an ideal solution for protocols operating at scale.

- Supports Popular DeFi Protocols

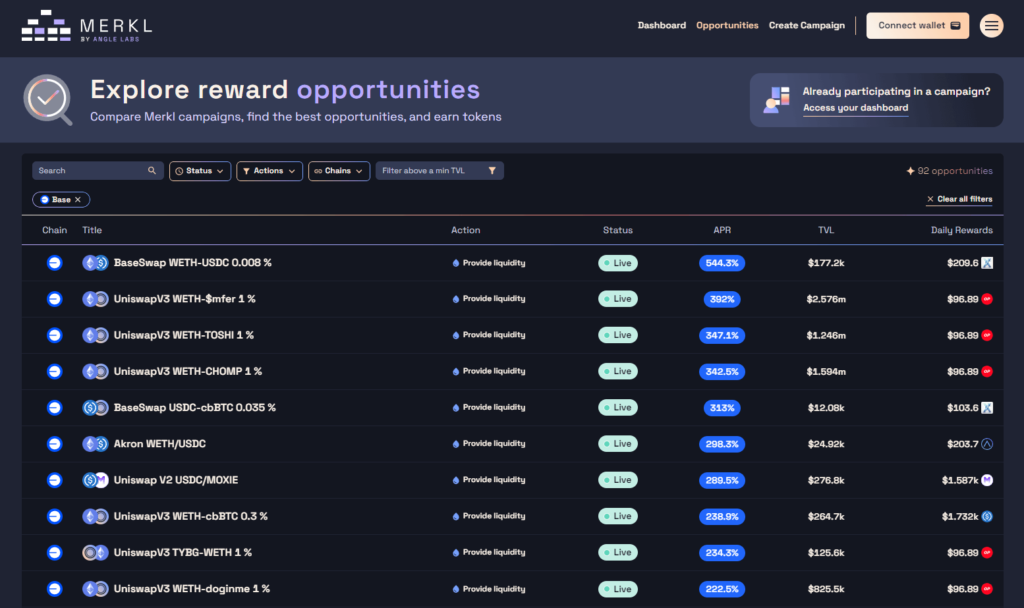

- Many well-known DeFi platforms are already integrated with Merkl, including DEXs like Uniswap, BaseSwap, and Curve. This widespread support ensures that liquidity providers can easily participate in multiple ecosystems while benefiting from a unified reward distribution system.

Why Angle V3 Chose Merkl

The Angle Protocol is a decentralized, capital-efficient stablecoin platform. With its recent V3 upgrade, Angle aims to further optimize stablecoin issuance and collateral management. Merkl plays a crucial role in this by enhancing liquidity provisioning for Angle’s pools, especially after its migration to Uniswap V3. By automating the distribution of rewards for LPs who provide liquidity in Angle’s pools, Merkl ensures that rewards are delivered in real-time, enhancing the efficiency of Angle’s DeFi ecosystem.

How Merkl Enhances DeFi Efficiency

For DeFi projects, Merkl reduces the operational overhead required to manage liquidity incentives. Traditionally, distributing rewards manually required complex coordination, smart contract updates, and periodic audits. With Merkl, these processes are automated, saving time and reducing the likelihood of human error. Projects using Merkl benefit from a scalable, flexible rewards system that enhances liquidity attraction and retention.

For liquidity providers, the advantage is clear: they can engage in DeFi with confidence, knowing that their rewards are being handled efficiently. Moreover, the real-time streaming of rewards allows LPs to adjust their strategies based on market conditions without worrying about delays or missed payouts.

Use Cases and Integrations

Merkl is already being used by several prominent DeFi projects to enhance liquidity incentives. Notably, platforms such as Uniswap, Curve, BaseSwap, and lending platforms like Aave and Compound have adopted Merkl’s reward system. By integrating with a variety of DeFi protocols, Merkl helps ensure that liquidity providers across the Ethereum and Base ecosystems have access to transparent and efficient rewards.

For example, on BaseSwap, liquidity providers who stake in pools can benefit from real-time rewards distributed through Merkl, optimizing their yield strategies and reducing the friction of traditional liquidity mining approaches.

The Future of Merkl in DeFi

As DeFi continues to grow, tools like Merkl are crucial for ensuring that liquidity providers are properly incentivized. The ability to dynamically adjust rewards, combined with the transparency of on-chain tracking, makes Merkl an indispensable tool for any DeFi project seeking to attract and retain liquidity.

For the broader ecosystem, Merkl’s approach to gas-efficient, real-time rewards sets a new standard for how liquidity incentives should be managed. As more projects integrate with Merkl, its impact on the DeFi space will likely grow, fostering a more efficient and interconnected financial system.

Conclusion

Merkl’s innovative approach to liquidity rewards is setting new standards in DeFi. With real-time reward distribution, gas efficiency, and deep integration with leading protocols like Angle and BaseSwap, Merkl is poised to be a vital part of the evolving DeFi landscape. Whether you’re a DeFi project looking to optimize liquidity incentives or an LP seeking more efficient rewards, Merkl offers a streamlined, secure solution.

To learn more about Merkl and explore its documentation, visit the official Merkl site.